The Frontier Fund

What is the Froniter Fund?

The Frontier Fund is a $100,000 fund managed by the UWA Student Managed Investment Fund (SMIF). Established in 2025, the fund is run purely by the SMIF society as a practical way to engage with the stock market using real money. We host regular meetings and events to update members with the progress of the fund, providing an excellent opportunity to meet the committee and learn the rationale behind our positions. The SMIF society also regularly meets with industry professionals, enabling students to pitch and communicate investment ideas for the Frontier Fund.

What Makes the Frontier Fund Unique?

Unlike student-managed funds at other Australian universities, the Frontier Fund emphasises ETF investment alongside more traditional stock picking activities. The fund uses index ETFs to greatly increase diversification opportunities, including international investment. ETF investment also facilitates exposure to several risk factors (e.g. Size, Value, Momentum) targeted by ASX-listed ETFs.

The fund also distinguishes itself from simulation-based funds through its use of real money. In particular, this enables participants to more effectively examine the role of the order book and market microstructure in investing. Related issues include the presence of algorithmic traders, price impact and slippage, brokerage, and dividend policies (including franking credits).

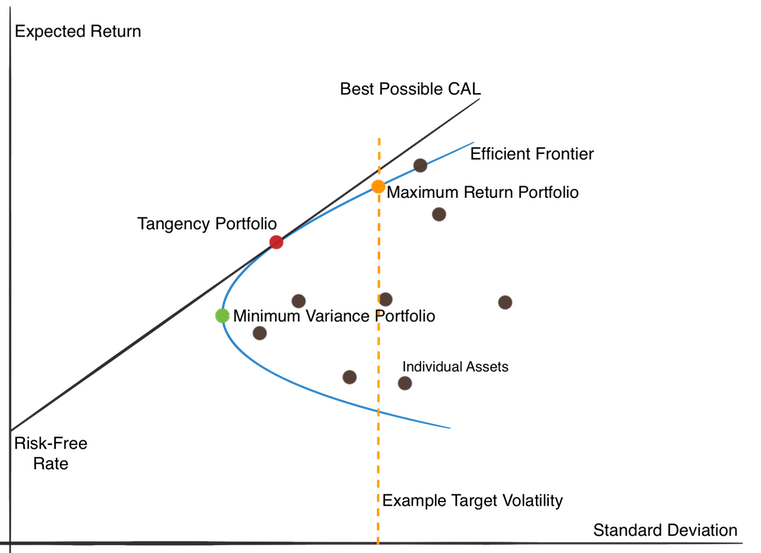

The fund is named after the Efficient Frontier in the Markowitz model of portfolio optimisation. In the Markowitz model, portfolios that lie on the efficient frontier represent the most efficient trade-offs between risk and return available within a given investment universe. As such, the name reflects the fund’s ongoing consideration of portfolio construction and diversification, over and above the more limited individual stock picking strategies typical of most student managed investment funds.

Beneficiaries & Benefactor

Students are the main beneficiaries of this groundbreaking fund. Established as an extension and complement to the theoretical education students gain through their degree, this opportunity to manage a real portfolio of money is a unique advantage of the UWA Business School.

Additionally, the fund is set to provide extensive charitable donations towards areas of high social impact around UWA. More specifically, the fund is scheduled to run for ten years, from 2025 to 2035, after which all positions will be liquidated and the capital donated around UWA. Potential beneficiaries include environmental and Indigenous causes. During the Frontier Fund’s ten-year period of operation, all dividends will be retained and reinvested, ensuring maximum compounding and the greatest possible realised return in 2035.

The initial capital of $100,000 was donated by Tom Simpson, a former student and researcher at the UWA Business School. Tom won the Andrew M Houston and Salter Memorial Prizes while completing an undergraduate economics degree, and subsequently completed a PhD in the economics department, focussing on the fine art market. He also holds an MSc Finance & Economics from the London School of Economics and is a major donor to the arts and education in Australia.

The Investment Memorandum document that formalised the fund’s inception in 2025 is available here.

Markowitz graphic sourced from Quantpedia